THE CHEMISTRY OF MISPRICING: WHY ADVANSIX (ASIX) IS A "DOLLAR FOR 50 CENTS"

When the market counts a company down and out, we take a second look. AdvanSix Inc. (NYSE: ASIX) is currently trading as if it were going out of business, having shed over 44% of its value in the last year. The "smart money" has fled the building, spooked by a cyclical downturn in nylon and a messy quarter.

But at Woodworth, we don't buy the narrative; we buy the numbers. And the numbers tell us that ASIX is a fortress balance sheet trading at 0.54x Book Value (0.61x Tangible Book) with a hidden cash flow catalyst that the market is completely ignoring. This is a classic "stretched rubber band" scenario where sentiment has detached from math.

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

If you want to clear a room at a cocktail party in 2026, tell them you’re excited about an auto-parts supplier undergoing a "transformation" during an EV slowdown. If you want to clear the room even faster, mention that its revenue is down double-digits and it just missed earnings.

Enter Methode Electronics (MEI).

At first glance, MEI looks like a textbook value trap. The stock is down nearly 40% over the last year, hovering around $7.50. Wall Street has effectively ghosted the company, treating it like a legacy relic that got lost on the way to the electric vehicle revolution. The consensus view is simple: the EV transition is stalling, Methode’s sales are shrinking, and the turnaround is taking too long.

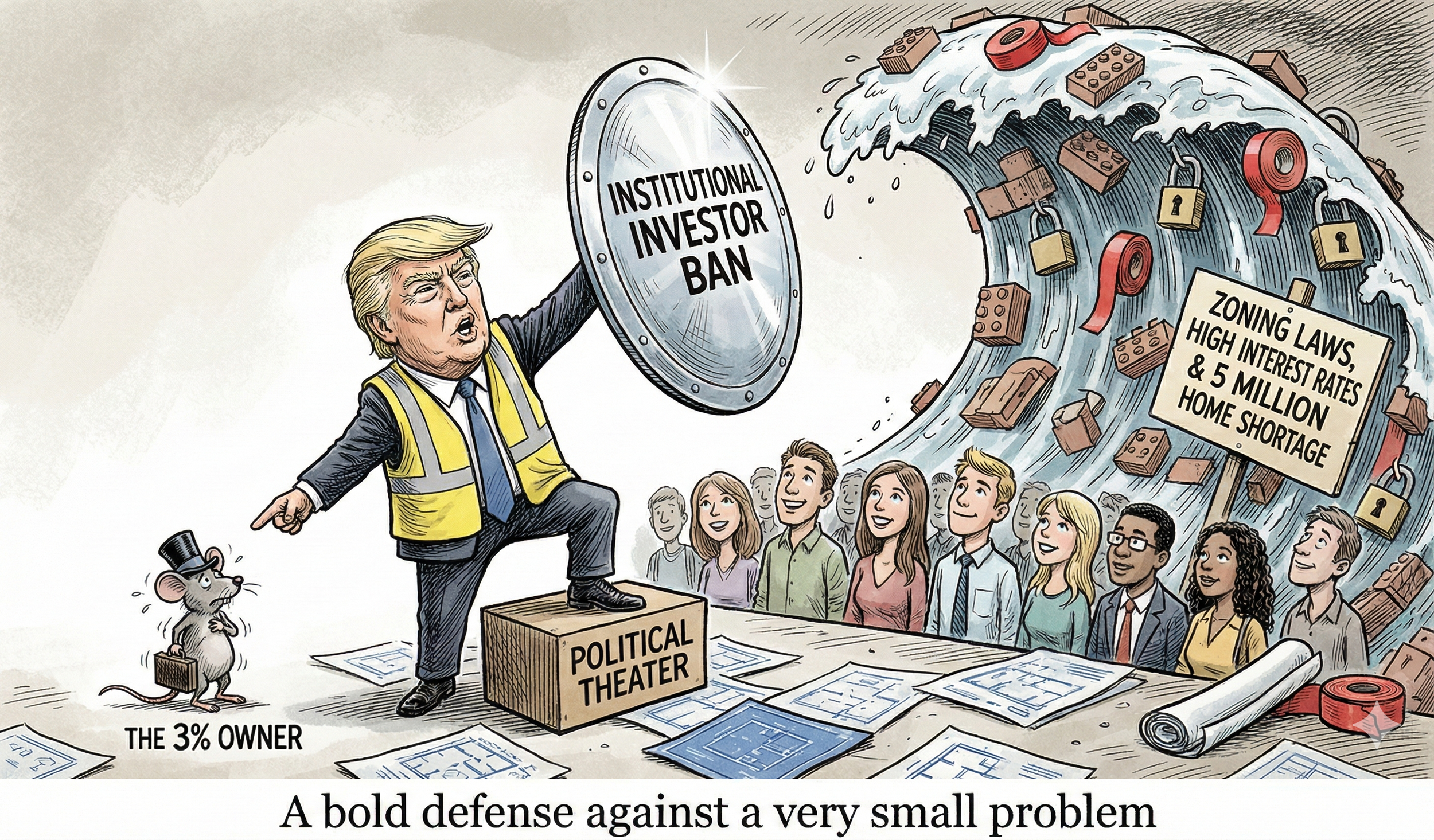

THE MILLEGAN MEMO: POST-DECEMBER 2025

December served up the full Woodworth sampler platter: Oregon’s market “scoreboard” gave us a mid-month sugar high and a month-end reality check, a 90s peso hangover reminded everyone that “international outperformance” can just be FX doing cardio, and a dating app the market ghosted might be lining up the rebound trade. We also dig into housing policy that keeps blaming the wrong villain while missing the supply mismatch, a coastal port pitch that sells greenfield automation and rail efficiency (and gets attacked for dredging while the Columbia quietly gets dredged for 100+ miles), the latest push to replace quarterly facts with semiannual vibes, and why faith in the economic data plumbing matters more than ever—because when the scoreboard gets politicized, markets don’t get calmer, they get louder.

— Managing Partners Drew Millegan & Quinn Millegan

SWIPED LEFT BY WALL STREET: THE BMBL REBOUND TRADE

Bumble looks like another “dead app” stock at first glance—revenue rolling over, consensus price targets drifting down, and big tech funds ghosting it like a bad first date. Under the hood, it is a turnaround in mid‑flight: cutting costs hard, consolidating assets like Fruitz and Geneva, and putting the founder back in charge at a price that bakes in way more heartbreak than the current business performance justifies.

MGP Ingredients Is Not Broken It’s Just Hungover: A Short Piece for Seeking Alpha

This will be our first full article published in Seeking Alpha - take a look here and please vote at the bottom of the Seeking Alpha article that our analysis was compelling! We were impressed with the thorough nature of the publication process through Seeking Alpha and look forward to future research articles. Learn more about why MGP Ingredients is an undervalued gem.

THE MILLEGAN MEMO: POST-NOVEMBER 2025

This month we revisit the original oil panic, the whiskey glut nobody noticed, homebuilders’ disappearing margins, the new WORM index for Oregon companies, and the only friend AI data centers really have - natural gas. In other words: 1970s stagflation, a hangover in a bourbon warehouse, housing builders racing each other to the bottom, and an energy transition that still quietly runs on methane. If you like panic, mispricing, and real assets that don’t care about your factor model, you’re in the right place. As a final note, the recent S&P rebalancing saw thirteen companies removed from the S&P 600 small cap index - three of them are current holdings. We like being part of the cast offs. This was even a signal to review each of the others as possible investment targets.

— Managing Partners Drew Millegan & Quinn Millegan

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

MGPI looks like another dead whiskey stock — down 75% in two years, trading at a “liquidation” multiple, and tossed in the penalty box for an inventory glut the market assumes will never clear. Under the hood, it’s the opposite story: cash flow is up, the balance sheet is a fortress, competitors are going bankrupt, and MGPI has nearly $470M in liquidity to buy stills, barrels, and brands at fire-sale prices. This deep dive walks through why the brown-goods crash is a textbook inventory cycle, how three growth engines (Penelope, El Mayor, and Ingredients) are being valued at roughly zero, and why our conservative work points to 50–200%+ upside with limited downside if things go wrong. If you like capital-cycle setups where sentiment has totally detached from math, this is one of them.

WILLAMETTE VALLEY VINEYARDS (WVVI): Not-So-Great Value

As an Oregon-based hedge fund, we often get the opportunity to more closely investigate local companies that are otherwise too small to register on most firms’ radars. Willamette Valley Vineyards (WVVI) is one of those companies. As one of the largest corporate vineyards in the state and a big player in a currently-ailing industry (the kids just don’t drink how they used to), it has shown up on our equity value screen programs more than a few times.

Unfortunately, just appearing in a value search does not make a value company. It is as much our job as managers to identify value traps as it is to pick out the potential true bargains. The low valuation of current trading seems to be justified. Let’s dig into why.

THE MILLEGAN MEMO: POST-OCTOBER 2025

This month’s Millegan Memo runs from Oregon dirt to Old Europe’s bond markets. On the company side, we walk through Helen of Troy’s “take your medicine” quarter, a local vineyard flagship that looks more like a capital structure problem than a bargain, and Stellantis, a misunderstood cash generator still priced like a restructuring project. On the macro and history side, we introduce the Woodworth Oregon Index and revisit the Peace of Westphalia to explain why the plumbing of institutions matters more to investors than whatever story is trending on financial TV.

- Managing Partners Drew Millegan & Quinn Millegan

HELEN OF TROY (HELE): Reset Creates Opportunity

We at the Woodworth Contrarian Fund specialize in finding buying opportunities when the market is selling. This means buying early and selling early - if you wait for the last drop of blood, they’re already dead, so to speak. Now with Q2 2026 Earnings in the rear view mirror, we think that this company is a classic contrarian value opportunity.

THE MILLEGAN MEMO: SEPTEMBER 2025

Helen of Troy (HELE) is cheap, wheat commodity corners collapse in 1871, the Woodworth Fund releases its Q3 Newsletter, and the yield curve flips back. Different centuries, same story: the market always humbles someone.

- Managing Partners Drew Millegan & Quinn Millegan

THE YIELD CURVE FLIP AND WHAT IT MEANS: RECESSION INDICATORS?

The current U.S. Treasury yield curve presents a complex picture that, while sharing some similarities with the 2007 pre-recession environment, occurs within a markedly different economic context. Check out today’s analysis.

THE MILLEGAN MEMO: POST-AUGUST 2025

Kohl’s keeps cashing checks while analysts call it a meme, Nvidia finds out it’s not the only chip in town, and the jobs market cools just enough to make everyone equally nervous. This issue sees earnings beats, $10B mystery orders, and tariffs that hit everyone—unless you’re big enough to dodge them.

- Managing Partners Drew Millegan & Quinn Millegan

SHOULD PUBLIC COMPANIES STOP REPORTING QUARTERLY EARNINGS?

Exclusively republished report from our archives - relevant today.

It seems that time and time again - the Trump administration proposes removing the requirement for public companies to report quarterly, instead favoring the European/Chinese standard of reports every 6 months.

THE MILLEGAN MEMO: POST-JULY 2025

Pfizer might be a good deal even if Bobby Kennedy bans child vaccines, PPI is heating up despite its cousin CPI, and with enough influence you too can be exempt from Tariffs! A little delayed for July, but worth it all the same.

- Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: JUNE 2025

Your pockets are inflating (a little bit more than expected), Nike bounces on bad news, and the US Dollar made records (not necessarily good ones).

- Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: MAY 2025

The US love-hate relationship with tariffs and market certainty, Abercrombie & Fitch is worth trying on (but it might not fit), and international trade (s)melt down. - Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: APRIL 2025

Your new Monday commute podcast - The Capital Call: with the Millegan Brothers and we explore Stellantis (formerly Fiat-Chrysler) and Moderna’s current value propositions in the market. - Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: MARCH 2025

Volatility is back and it’s provided more buying opportunities than capital - we highlighted RAIL and KSS which have interesting stories and are at even more interesting price levels with some insight into our investment process and contrarian philosophy. - Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: FEBRUARY 2025

Intel’s potential breakup has the company poised for exciting times, Stellantis earnings show a strong balance sheet, and the yield curve partly inverts as recession fears loom. - Managing Partners Drew Millegan & Quinn Millegan