THE MILLEGAN MEMO: MAY 2025

Brought to you by The Woodworth Contrarian Fund

The US love-hate relationship with tariffs and market certainty, Abercrombie & Fitch is worth trying on (but it might not fit), and international trade (s)melt down.

- Managing Partners Drew Millegan & Quinn Millegan

“Value in an investment is similar to character in an individual – it stands up better in adversity.”

LISTEN TO THE MILLEGAN BROTHERS ON THE CAPITAL CALL PODCAST: YOUR MORNING COMMUTE EVERY MONDAY

TARIFFS ARE ON! NO, WAIT THEY’RE OFF? …AND BACK ON AGAIN?

Photo by Ajay Suresh from New York, NY, USA - United States Court of International Trade, CC BY 2.0, https://commons.wikimedia.org/w/index.php?curid=79940470

Some of the Trump Administration’s April 2nd tariffs were briefly struck down as illegal by the U.S. Court of International Trade, but the ruling was quickly stayed by the US Court of Appeals pending appeal at the Administration’s request. Tariffs have, consequently, returned. The case was originally brought before the federal courts by a coalition of 12 states, led by Oregon, that felt unfairly impacted by the sudden imposition of import sales taxes, and believed them to be illegally implemented. The plaintiffs had asked the court to issue a permanent injunction barring the application of Tariffs in this manner. The Court of International Trade ruled on Wednesday that the Administration had overstepped authority derived from the International Economic Emergency Powers Act of 1977 in order to justify the “reciprocal” tariffs. The White House press secretary, Karoline Leavitt, criticized the decision, stating that the members of the three-judge panel “brazenly abused their judicial power to usurp the authority of President Trump” and that the courts “should have no role here.” Meanwhile, Senior Judge Jane A. Restani, who was nominated to the US Court of International Trade by President Ronald Reagan, stated that “it may be a very dandy plan, but it has to meet the statute.” The Administration then sought a temporary hold on the injunction, pending appeal, which was granted by the US Court of Appeals on Thursday while they decide whether or not to uphold the lower court's decision.

The market doesn’t care what the rules are - it just needs to know what they are so it can act accordingly. This has left investors dazed and confused. What else is new? The saving grace of the current situation as far as the market is concerned, is that nothing coming from high level trade negotiations is being taken as fact or with any permanence at this point - the street appears to have already priced in that the only certainty is that nothing is certain. This has led to outsized returns coming from companies with good fundamentals versus more speculative momentum names - which is exactly what fundamentals-driven contrarian value investors, such as ourselves, like to see. This is a stock-picker’s market.

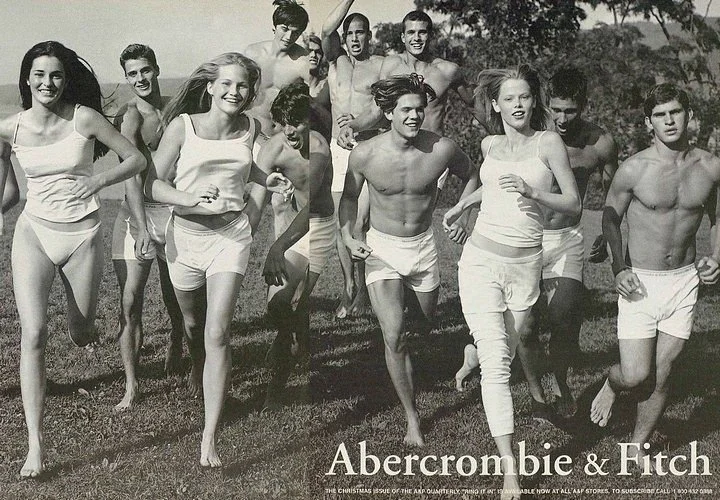

TRYING ON $ANF FOR SIZE: ABERCROMBIE & FITCH

Abercrombie and Fitch could be undervalued relative to its peers. Relative to other clothing retailers, Abercrombie stands out as being particularly cheap, trading at just under three times book valuation and relatively cheap price to earnings multiple. Like other retailers, the company is exposed to the effects of heavy import taxes, particularly for the sections of its supply chain centered in Asia, including China. In combination with weak forward guidance, ANF has dropped from a pre-inauguration market capitalization of over $7 Billion to less than $4 Billion, as of writing. Still, the company remains profitable (reporting Q1 profits of $1.59/share), and commands a relatively healthy balance sheet.

High previous year earnings obscures short-term analysis, and may be at the root of volatility. ANF experienced a banner year in their fiscal 2024, earning $6.53 per share of revenue over the year. This was the highest earnings posted in the last 20 years of operations at the company, even eclipsing the previous 2008 peak earnings of $5.45 per share. It is no surprise, then, that investors had reset their expectations of the company - even accounting for current year over year share price declines, the company is hovering near its 2011 and 2008 trading peaks. As such, short term earnings comparisons may be inappropriate. Taking the long view and based on our own proprietary internal valuation models, the company sits about in the middle of its expected historic trading range, meaning that while it could be a fair deal at current prices, there is also potential for further discounting before ANF truly becomes a bargain-bin diamond in the rough. It definitely remains on our ‘potentials’ radar.

Please note that at the time of this publication, neither the Millegan Brothers nor the Woodworth Contrarian Stock & Bond Fund, LP hold a position in ANF; however, either the Millegan Brothers or the Woodworth Contrarian Stock & Bond Fund, LP may or may not take a position in ANF in the future and may or may not be in and out of the position at their own discretion from time to time.

STEELING THE SPOTLIGHT: METAL TARIFFS CRANKED UP TO 50%

On Friday, the US doubled down on steel import tariffs, raising from rates of 25% to 50%. This increase comes off the heels of a breakdown in trade agreements between the US & China at a joint Geneva-based negotiations. The Trump administration has justified the increase as a way to both boost local steel manufacturing and also decrease reliance on Chinese steel imports. The initial 25% steel tariffs have been in place since Trump’s first term in 2018, and were maintained during the Biden presidency.

In the President’s own words, “at 50%, they can no longer get over the fence.” This high level of steel tariffs on foreign imports presents a difficult value proposition for firms importing steel into the US. If that is the goal, this is not a bad way to accomplish it. The President has postured that this will boost US manufacturing and strip us of our reliance on steel imports. Intuitively, this would make sense, but, in practice, it remains to be seen how effective such a plan would be. The US is a massive manufacturer of finished goods that relies upon cheap foreign imports. Removing access to those cheap, basic foreign imports and imported manufacturing equipment has the potential to actually shutter many manufacturing plants and small businesses in the US. While both the Trump & Biden administrations have expressed their desire to protect companies like US Steel, they represent an increasingly irrelevant percentage of global steel production, and have lost market share largely due to a failure to remain competitive. Studies of the 2018 steel tariffs show that, for every one steel producing job gained, a whopping 75 jobs were lost at firms that consumed steel as a result of the tariffs.

DEEP ROOTS. STUBBORN GROWTH. OREGON-BASED.

Now is a great time to diversify your portfolio with an investment into an award-winning fund. Call us or visit our website to inquire on an investment today in the Woodworth Contrarian Fund as an accredited investor.

(800) 651-1996 - info@woodworth.fund - www.Woodworth.Fund

Best Value-Based Fund '22 | Best Contrarian Managers '22, ‘23, ‘24 | Best Opportunistic High Yield Hedge Fund ‘24

Contrarian Value-Based Hedge Fund of the Year for ‘22/23 & ‘23/’24

Drew Millegan (left) & Quinn Millegan (right) in front of the Charging Bull in New York City.

About the Managers: Brothers Drew Millegan and Quinn Millegan manage the Woodworth Contrarian Stock & Bond Fund, a hedge fund based in McMinnville, Oregon. They grew up in the finance world, and specialize in contrarian investment strategies in the US Public and Private markets.

Something missing from your portfolio may be a diversification into the Woodworth Contrarian Fund for accredited investors. Now is a great time to diversify your portfolio with an investment into a multi-award-winning fund. An exposure to a value-based contrarian strategy is a unique opportunity for your long term capital that you’re seeking aggressive returns for. With eight years of the Woodworth Fund under management, the Millegan Brothers are trained stock-pickers and experienced venture capital investors with a proven track record. Give us a call today to discuss a liquid investment with independent administration and independently audited monthly statements and a personal relationship.