THE MILLEGAN MEMO: POST-DECEMBER 2025

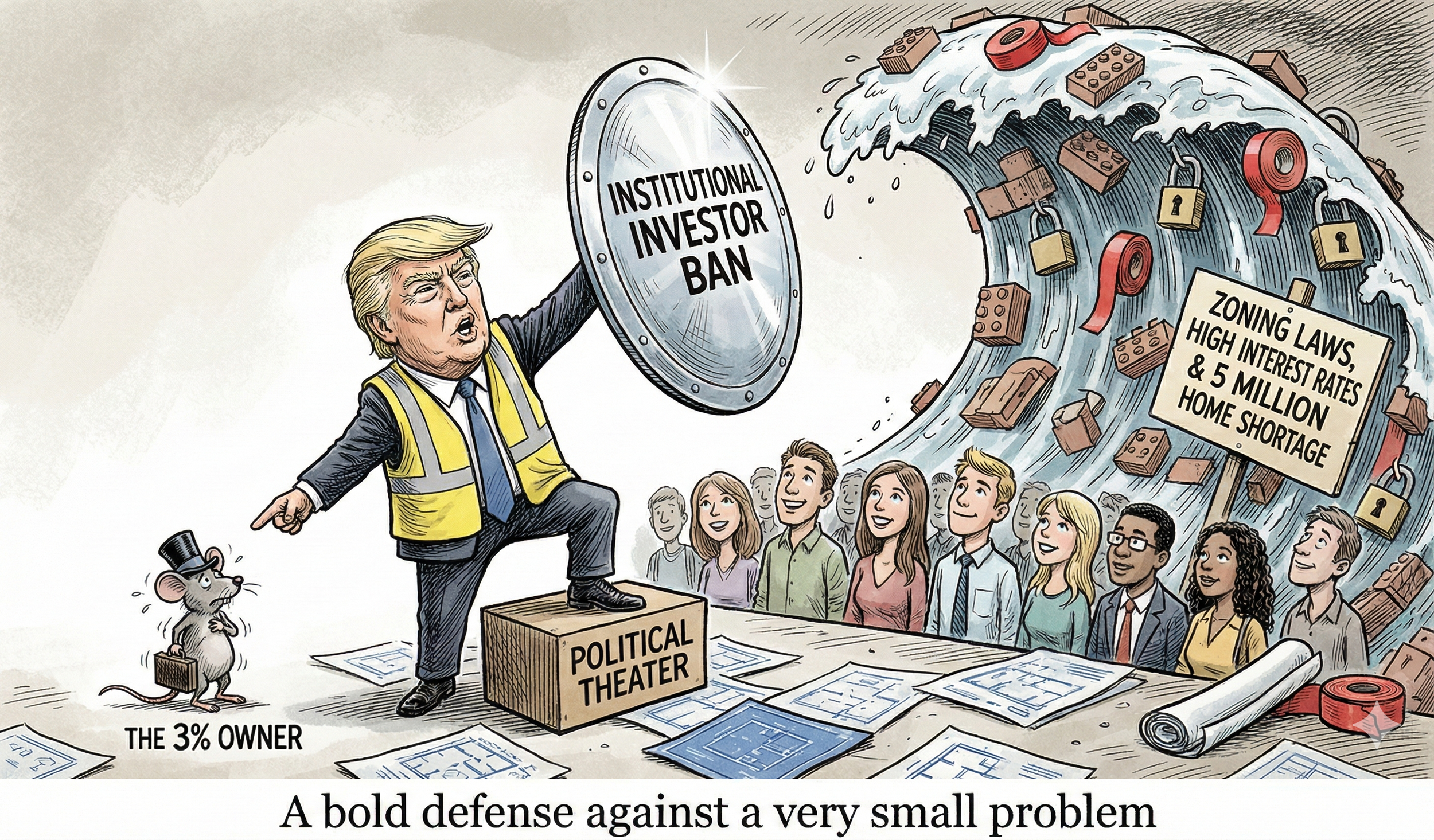

December served up the full Woodworth sampler platter: Oregon’s market “scoreboard” gave us a mid-month sugar high and a month-end reality check, a 90s peso hangover reminded everyone that “international outperformance” can just be FX doing cardio, and a dating app the market ghosted might be lining up the rebound trade. We also dig into housing policy that keeps blaming the wrong villain while missing the supply mismatch, a coastal port pitch that sells greenfield automation and rail efficiency (and gets attacked for dredging while the Columbia quietly gets dredged for 100+ miles), the latest push to replace quarterly facts with semiannual vibes, and why faith in the economic data plumbing matters more than ever—because when the scoreboard gets politicized, markets don’t get calmer, they get louder.

— Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: POST-NOVEMBER 2025

This month we revisit the original oil panic, the whiskey glut nobody noticed, homebuilders’ disappearing margins, the new WORM index for Oregon companies, and the only friend AI data centers really have - natural gas. In other words: 1970s stagflation, a hangover in a bourbon warehouse, housing builders racing each other to the bottom, and an energy transition that still quietly runs on methane. If you like panic, mispricing, and real assets that don’t care about your factor model, you’re in the right place. As a final note, the recent S&P rebalancing saw thirteen companies removed from the S&P 600 small cap index - three of them are current holdings. We like being part of the cast offs. This was even a signal to review each of the others as possible investment targets.

— Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: POST-OCTOBER 2025

This month’s Millegan Memo runs from Oregon dirt to Old Europe’s bond markets. On the company side, we walk through Helen of Troy’s “take your medicine” quarter, a local vineyard flagship that looks more like a capital structure problem than a bargain, and Stellantis, a misunderstood cash generator still priced like a restructuring project. On the macro and history side, we introduce the Woodworth Oregon Index and revisit the Peace of Westphalia to explain why the plumbing of institutions matters more to investors than whatever story is trending on financial TV.

- Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: SEPTEMBER 2025

Helen of Troy (HELE) is cheap, wheat commodity corners collapse in 1871, the Woodworth Fund releases its Q3 Newsletter, and the yield curve flips back. Different centuries, same story: the market always humbles someone.

- Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: POST-AUGUST 2025

Kohl’s keeps cashing checks while analysts call it a meme, Nvidia finds out it’s not the only chip in town, and the jobs market cools just enough to make everyone equally nervous. This issue sees earnings beats, $10B mystery orders, and tariffs that hit everyone—unless you’re big enough to dodge them.

- Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: POST-JULY 2025

Pfizer might be a good deal even if Bobby Kennedy bans child vaccines, PPI is heating up despite its cousin CPI, and with enough influence you too can be exempt from Tariffs! A little delayed for July, but worth it all the same.

- Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: JUNE 2025

Your pockets are inflating (a little bit more than expected), Nike bounces on bad news, and the US Dollar made records (not necessarily good ones).

- Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: MAY 2025

The US love-hate relationship with tariffs and market certainty, Abercrombie & Fitch is worth trying on (but it might not fit), and international trade (s)melt down. - Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: APRIL 2025

Your new Monday commute podcast - The Capital Call: with the Millegan Brothers and we explore Stellantis (formerly Fiat-Chrysler) and Moderna’s current value propositions in the market. - Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: MARCH 2025

Volatility is back and it’s provided more buying opportunities than capital - we highlighted RAIL and KSS which have interesting stories and are at even more interesting price levels with some insight into our investment process and contrarian philosophy. - Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: FEBRUARY 2025

Intel’s potential breakup has the company poised for exciting times, Stellantis earnings show a strong balance sheet, and the yield curve partly inverts as recession fears loom. - Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: JANUARY 2025

How stock pickers outperform the market, the Woodworth Contrarian Fund’s Q4 Newsletter, and the State of Greenland - Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: DECEMBER 2024

Brought to you by The Woodworth Contrarian Fund. Black Friday, an alternative measure of inflation, and Quinn calls in on Jim Cramer’s Lightning Round on his CNBC show Mad Money. Happy Holidays and Happy Friday the 13th.

THE MILLEGAN MEMO: NOVEMBER 2024

Tariffs, The Election, and whether or not you can be a better investor by knowing the future. We decided to do something a little bit different this month. We have a few bite sized pieces on interesting topics that caught our eye as we look forward. We call it the Millegan Memo.