THE MILLEGAN MEMO: POST-DECEMBER 2025

Brought to you by The Woodworth Contrarian Fund

December served up the full Woodworth sampler platter: Oregon’s market “scoreboard” gave us a mid-month sugar high and a month-end reality check, a 90s peso hangover reminded everyone that “international outperformance” can just be FX doing cardio, and a dating app the market ghosted might be lining up the rebound trade. We also dig into housing policy that keeps blaming the wrong villain while missing the supply mismatch, a coastal port pitch that sells greenfield automation and rail efficiency (and gets attacked for dredging while the Columbia quietly gets dredged for 100+ miles), the latest push to replace quarterly facts with semiannual vibes, and why faith in the economic data plumbing matters more than ever—because when the scoreboard gets politicized, markets don’t get calmer, they get louder.

— Managing Partners Drew Millegan & Quinn Millegan

“The secret to successful investing is relatively simple: Figure out the value of something and then pay a lot less.”

WORM Index: December update

The Woodworth Oregon Market Index (WORM) finished December up ~1.6%, rising from 3,051.55 (11/29) to 3,099.83 (12/31)—after tagging a mid-month high of roughly 3,246.40 before fading into month-end (about a ~4.5% pullback from the peak). Thesis: WORM’s job isn’t to be “right” every month—it’s to be a clean, Oregon-native scoreboard we can compound ideas against (and it is not the Woodworth portfolio, not reflective of our fund performance, and not an investable product).

WORM is still young, but it’s already doing what indexes do best: forcing intellectual honesty. If your “Oregon economy” narrative doesn’t match the tape, that’s useful—because it tells you what you need to investigate next (rates, cyclicals, consumer, energy, etc.). For clarity: WORM is a research/market-tracking index only; it does not represent what Woodworth is invested in, it does not track Woodworth returns, and you cannot buy it as a product. If you want the live level and the running archive, it’s all on the WORM page.

Bumble (BMBL): recap + one more reason we like it

Bumble looks like “dead app” equity to the lazy screeners, but the setup is already flirting with a turnaround: costs getting ghosted, non-core assets getting unfriended, the founder back in the chair, and a valuation that assumes this thing is permanently stuck in “no matches.” Thesis: BMBL doesn’t need a fairy-tale relationship — it just needs to stop giving investors the ick, and the stock can go from left-swipe to “so… you up?”

Short interest is the accelerant here, not the thesis. As of the mid-December reporting date, BMBL shows elevated short positioning (short % of float often cited in the ~20%+ neighborhood depending on float definition/data vendor). If the operating story improves even modestly, the “everyone agrees it’s bad” positioning can unwind fast—because nothing moves a stock like shorts getting dumped and realizing they’re the ones being left on read.

In our full piece — Swiped Left by Wall Street: The BMBL Rebound Trade — we walk through the core turnaround mechanics, what “good enough” execution looks like, and why the current price implies a breakup that may already be getting reversed in real time. (Full article: Swiped Left by Wall Street: The BMBL Rebound Trade — link to the research piece here.)

Please note that the Woodworth Contrarian Stock & Bond Fund, LP, of which the Millegan Brothers manage and are invested in, currently hold a position of BMBL as of the publication date of this article. They may or may not choose to modify their exposure to this name for any reason at any time. This is not a recommendation to buy or sell BMBL or any other name - investments incur significant risk, our risk tolerance may be significantly higher than the average investor, and any discussion in this article does not take into consideration your individual circumstances.

December in Economic History: 1994 - Mexico’s “Tequila Crisis”

On December 20, 1994, Mexico announced a peso devaluation that shocked markets and kicked off what became known as the “Tequila Crisis”—the name wasn’t about margaritas, it was about contagion: like a bad shot passed around the room, Mexico’s currency blow-up quickly spilled into broader emerging-market confidence. The setup was classic: Mexico had been running a managed exchange rate while relying heavily on short-term capital, and when political/market stress rose, investors rushed for the exits and the government’s ability to defend the peso evaporated. The “tequila” label stuck because the crisis became a symbol of how quickly sentiment + capital flight can turn a policy adjustment into a full-blown market event—one that ultimately required a large international support package to stabilize funding and confidence. Fast-forward: part of the recent resurgence in “foreign is back” investing is simply Americans rediscovering that when the dollar falls, overseas assets look brilliant in USD terms. In 2025, one breakdown shows the MSCI EAFE returned 31.2% in USD but 20.6% in local currency, implying roughly +8.8% from FX (about ~28% of the total USD return coming from currency translation rather than local-market gains). A real-world proxy says the same thing: EFA (unhedged) returned 31.55% in 2025 vs HEFA (currency-hedged) at 23.25%. When you buy foreign equities, you’re also buying a currency—and lately that “currency sleeve” has been a huge chunk of the ride.

The punchline is not “don’t own foreign” — it’s “know what you own.” A weaker dollar helped make 2025 look like a long-overdue “international renaissance,” with the dollar down over 9% on the year by some measures. But Mexico 1994 is the reminder that FX regimes can break suddenly, and currency moves can dwarf an otherwise-correct equity thesis—especially in places where confidence and capital flows matter as much as earnings. If your foreign thesis is “valuation + mean reversion,” but your return driver is secretly “USD down,” you’re not diversified—you’re just running a macro book by accident. The practical takeaway: size EM and high-FX-risk markets like they can gap against you, and decide explicitly (not emotionally) whether you want unhedged currency exposure or you just want foreign businesses with the currency noise muted.

Trump’s proposed ban on institutional SFH buyers: satisfying villain, perverse incentives

President Trump says he’s taking steps to ban large institutional investors from buying more single-family homes, framing it as an affordability fix, but the mechanism and scope are still murky. The base rates don’t cooperate: the GAO estimates that by mid-2022, 32 investors (1,000+ homes each) owned ~450,000 single-family rentals—about ~3% of the SFR market, and the five largest were around ~2%. Meanwhile, the story most people picture—institutions scooping houses off Zillow—is increasingly dated; major SFR operators and analysts describe a growing share of acquisitions coming directly from homebuilders via build-to-rent pipelines, not by bidding wars on the MLS. Thesis: even if implemented, this is mostly political theater—and it risks reducing future supply by kneecapping a buyer channel that helps builders finance and de-risk new construction (and by extension, harms renters too).

Housing policy that forgets renters is housing policy that forgets most people. A large share of households either don’t qualify for a mortgage or aren’t in a position to buy even if they’d like to—credit constraints, down payments, debt-to-income rules, and higher rates mean renting isn’t a lifestyle choice so much as the default setting for a big chunk of the country. Pretium Founder/CEO Don Mullen (whose firm owns Progress Residential) has pointed to how builders actually manage risk: imagine a subdivision of 100 homes. If a builder can secure an institutional commitment to buy ~25 at completion, it reduces absorption risk, improves financing certainty, and can make the builder willing to start the project in the first place (and start the next one after it). Pretium has leaned into that financing gap with homebuilder lending designed to fund construction of thousands of new homes—capital tied to net new supply, not just trading existing homes back and forth. And since much of this model is purpose-built rental, banning it doesn’t “free up” listings for first-time buyers; it can simply mean fewer units get built, and the people who most need more options—renters—get fewer choices and higher prices.

And stepping back, some of the best housing research coming out right now argues the “shortage” isn’t a single magic number—it’s a mismatch between the kinds of homes we built (and where we built them) and what modern households actually look like. If that framing is even directionally right, then scapegoating one marginal buyer class is a distraction: the fix is housing variety + more flexible land-use, not a ban that makes new supply harder to finance.

Coos Bay’s port push: greenfield efficiency meets brownfield politics

A ship is loaded with logs for export at the port on Coos Bay in North Bend (Gary Halvorson 2011)

The proposed Pacific Coast Intermodal Port (PCIP) in Coos Bay is being pitched as the first fully ship-to-rail container facility on the U.S. West Coast—i.e., containers move train-to-ship instead of piling onto drayage trucks, with electrified ship-to-shore gantry cranes and shore power to cut diesel-at-berth emissions. PCIP proponents also emphasize that the terminal would sit about 6 miles from open ocean, which matters because it avoids the long river transit and ongoing maintenance dredging burden that legacy inland ports require. For example, the Port of Portland notes its dredge maintains a channel for ~100 miles from near Astoria to Portland Harbor, not to mention the expansive lower Columbia navigation channel project which plans to deepen and extend the channel. Thesis: the real debate isn’t “can Coos Bay be a port?”—it’s whether a modern, ship-to-rail, electrified greenfield terminal can overcome the commercial, political, and labor realities that make West Coast logistics sticky.

The underappreciated angle here is that PCIP is selling a different operating model—not just a different location. A purpose-built ship-to-rail facility is naturally set up to pursue the kinds of automation and throughput efficiencies that are hard to bolt onto older U.S. ports (and automation is exactly where U.S. port politics gets spicy, because unions and employers fight over technology that changes headcount and job content). That’s why the narrative splits: supporters talk about fewer truck moves, fewer choke points, and faster velocity, while critics often frame it as an environmental dredging story or a labor displacement story—sometimes without acknowledging that the region already depends on continuous, large-scale dredging to keep the Columbia system navigable for trade. The clean way to evaluate it is commercial-first: will carriers commit, will rail economics stay attractive at scale, and can the project deliver “bankable” reliability without turning into a decade-long capex/permitting swamp—because if those boxes don’t check, no amount of automation rhetoric will matter.

Quarterly earnings aren’t the problem — they’re the antidote

In September 2025, President Trump again urged a shift from mandatory quarterly reporting to semiannual reporting, and reporting since then indicates SEC Chair Paul Atkins is open to fast-tracking the idea (potentially making quarterly reporting optional rather than required). The U.S. quarterly filing framework (Form 10-Q) has been a core disclosure cadence since the 1970 era, and the current debate echoes the same “short-termism” pitch you saw in 2018. We’ve actually been here before: in our Aug. 29, 2018 letter (“Public companies should not do away with quarterly earnings”), we argued that removing quarterly reporting mostly removes transparency and just increases speculation. And it’s telling that one of our current holdings, Stellantis (STLA), has been moving the opposite direction—toward more frequent quarterly-style disclosure (Q1 and Q3 updates plus quarterly materials), because serious capital tends to prefer daylight. Thesis: moving from quarterly to semiannual reporting doesn’t reduce volatility — it just replaces facts with vibes and hands more edge to insiders and rumor mills.

More information is better — and less information is a speculative tax you don’t see until you’re paying it. If you stretch the reporting window from 90 days to 180, you don’t eliminate the human urge to forecast; you just force everyone to guess for twice as long, with fewer “hard resets” from actual numbers. That means wider uncertainty bands, more narrative-driven price action, and bigger air pockets when reality finally drops at earnings (because earnings can’t be fluffed the way a storyline can). Quarterly reporting isn’t what creates short-termism—comp structures and guidance games do; the cure for bad incentives isn’t darkness, it’s better incentives plus disclosure. If policymakers want fewer “quarterly theatrics,” fine—attack the theater (guidance culture, payout metrics), but keep the scoreboard.

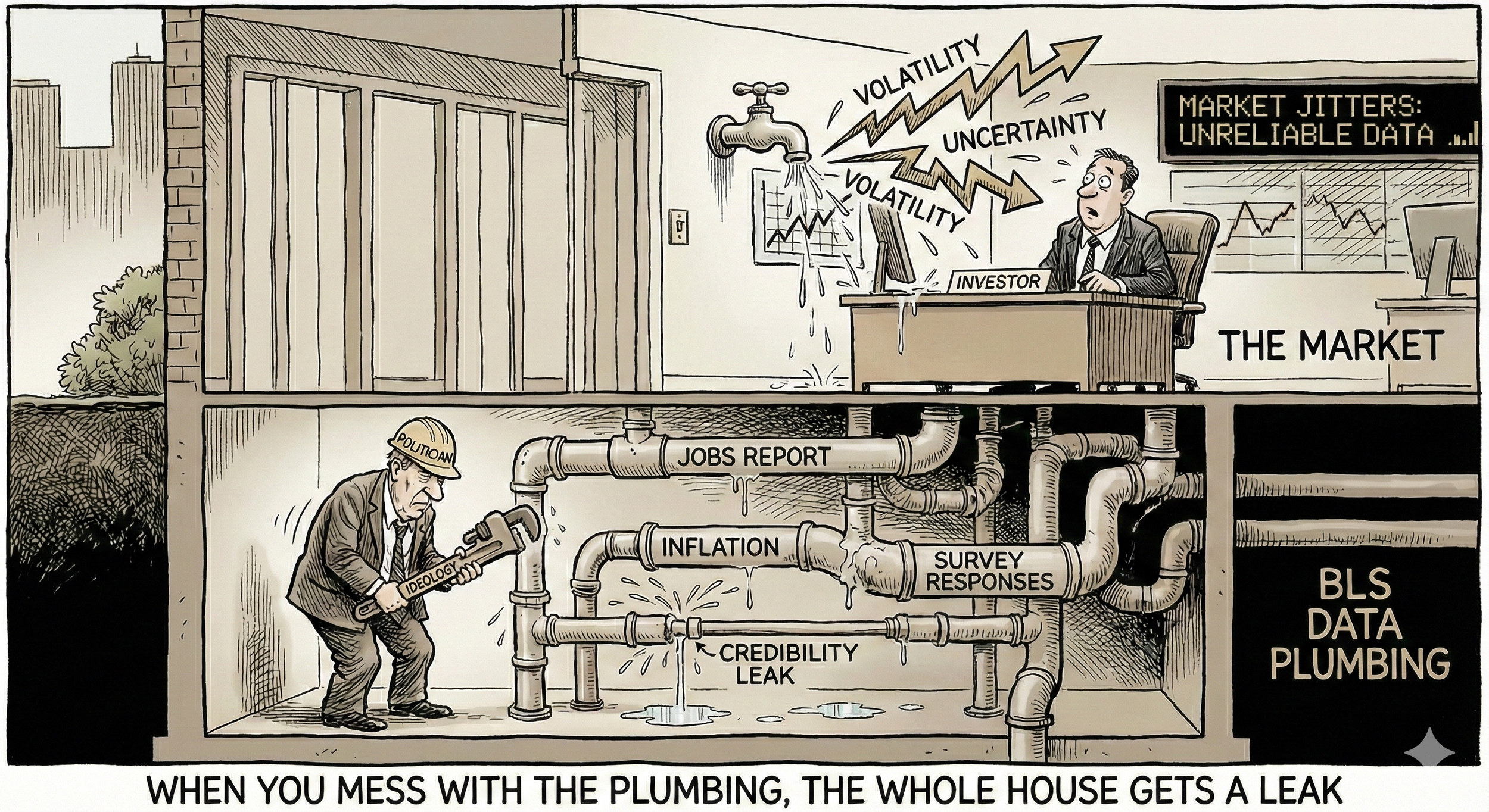

BLS data trust: when the scoreboard gets politicized, markets get jumpier

Over the past year, the perception of “clean” U.S. economic data has taken hits from multiple angles: survey response rates are falling (the CPS response rate hit 64.0% in November 2025, a series low), key series regularly undergo seasonal-factor and other revisions, and Washington has increasingly dragged statistical institutions into the headline cycle. On top of that, the administration disbanded major expert advisory panels that helped refine federal economic statistics, and the BLS Commissioner was fired after a weak jobs report—moves that prompted economists and investors to worry about credibility, regardless of the underlying reality of the data. Thesis: when confidence in the data “plumbing” erodes, volatility rises—because markets are forced to trade narratives longer, and reality hits harder at earnings.

Less trustworthy macro data doesn’t reduce uncertainty—it just relocates it into price action. When investors can’t rely on the usual “hard reads” (jobs, inflation, participation, wage trends) they don’t stop forecasting; they just guess louder, and the market gaps more when a real datapoint finally lands—especially when companies report earnings, where the cash register is harder to hand-wave than a survey estimate. That’s where the McCarthyism parallel matters (in an apolitical way): the Army–McCarthy hearings reached a turning point when Joseph Welch finally asked, “Have you no sense of decency?”—a public line that crystallized how corrosive intimidation and insinuation can be to institutions. Our family’s version of this lesson is personal: our grandfather Millegan worked at the State Department and served as the main advisor to Wisconsin’s senior senator while the junior senator was McCarthy; he watched colleagues and friends accused, ruined, and in some cases arrested—until he cast what he believed was the only protest vote available to him - the only vote for the communist party in Fairfax county, Virginia. The market takeaway is simple: institutions matter, and when you make the referees part of the brawl, you don’t get “better outcomes”—you get noisier games.

DON’T FOLLOW THE CROWD. CALL US TODAY & INVEST CONTRARIAN.

If you’re seeking liquid access to institutional insights within a hands-on managed, direct investment portfolio featuring differentiated strategies, the Woodworth Contrarian Fund is open to new capital. We prioritize personalized service and building lasting relationships with our investors — because your goals deserve tailored attention and transparent communication.

Ready to explore how our contrarian approach can complement your portfolio? Reach out directly to our team for detailed fund information, eligibility for accredited investors, and next steps.

Stay informed by subscribing to the Millegan Memo and listening to the Capital Call podcast, where we share timely perspectives and in-depth market analysis.

Your next investment opportunity begins with a conversation — contact us today to learn more.

DEEP ROOTS. STUBBORN GROWTH. OREGON-BASED.

Now is a great time to diversify your portfolio with an investment into an award-winning fund. Call us or visit our website to inquire on an investment today in the Woodworth Contrarian Fund as an accredited investor.

(800) 651-1996 - info@woodworth.fund - www.Woodworth.Fund

Contrarian Value-Based Hedge Fund of the Year 2022-2024

Quinn Millegan (left) & Drew Millegan (right)

About the Managers: Brothers Drew Millegan and Quinn Millegan manage the Woodworth Contrarian Stock & Bond Fund, a hedge fund based in McMinnville, Oregon. They grew up in the finance world, and specialize in contrarian investment strategies in the US Public and Private markets.

Something missing from your portfolio may be a diversification into the Woodworth Contrarian Fund for accredited investors. Now is a great time to diversify your portfolio with an investment into a multi-award-winning fund. An exposure to a value-based contrarian strategy is a unique opportunity for your long term capital that you’re seeking aggressive returns for. With nine years of the Woodworth Fund under management, the Millegan Brothers are trained stock-pickers and experienced venture capital investors with a proven track record. Give us a call today to discuss a liquid investment with independent administration and independently audited monthly statements and a personal relationship.