THE MILLEGAN MEMO: POST-DECEMBER 2025

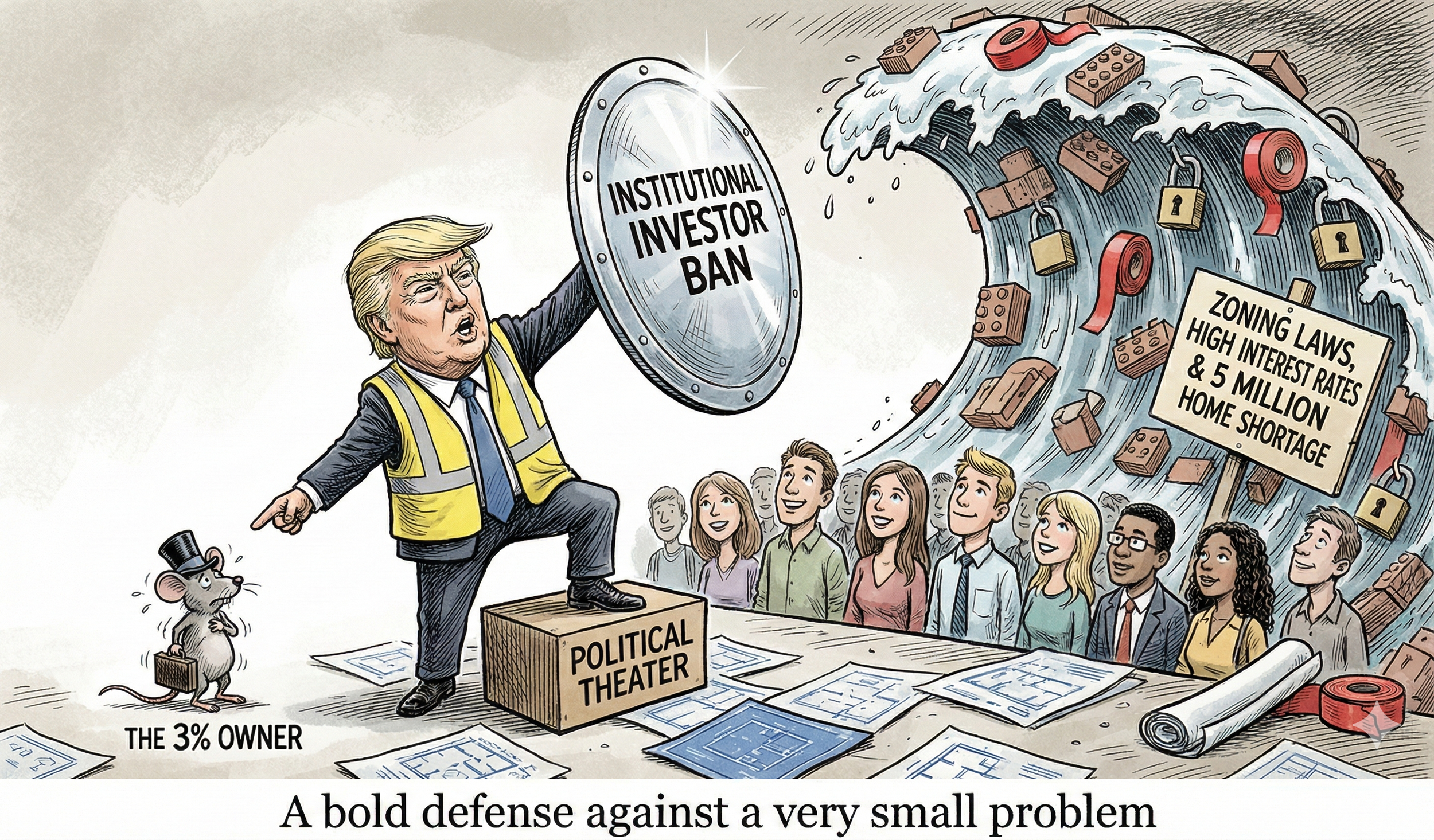

December served up the full Woodworth sampler platter: Oregon’s market “scoreboard” gave us a mid-month sugar high and a month-end reality check, a 90s peso hangover reminded everyone that “international outperformance” can just be FX doing cardio, and a dating app the market ghosted might be lining up the rebound trade. We also dig into housing policy that keeps blaming the wrong villain while missing the supply mismatch, a coastal port pitch that sells greenfield automation and rail efficiency (and gets attacked for dredging while the Columbia quietly gets dredged for 100+ miles), the latest push to replace quarterly facts with semiannual vibes, and why faith in the economic data plumbing matters more than ever—because when the scoreboard gets politicized, markets don’t get calmer, they get louder.

— Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: POST-OCTOBER 2025

This month’s Millegan Memo runs from Oregon dirt to Old Europe’s bond markets. On the company side, we walk through Helen of Troy’s “take your medicine” quarter, a local vineyard flagship that looks more like a capital structure problem than a bargain, and Stellantis, a misunderstood cash generator still priced like a restructuring project. On the macro and history side, we introduce the Woodworth Oregon Index and revisit the Peace of Westphalia to explain why the plumbing of institutions matters more to investors than whatever story is trending on financial TV.

- Managing Partners Drew Millegan & Quinn Millegan

CAPITAL CALL #10: TESLA’S OVERPRICED, STELLANTIS IS CHEAP, & THE SEC HAS A BIRTHDAY

Tesla’s still pretending it’s a tech company, Stellantis is still pretending it’s a cool name, and Elon’s reality show got picked up by the White House. We break down whether SpaceX could survive a government “upgrade,” how tariffs are the financial version of playing chicken with yourself, and why Stellantis might just be the least-loved bargain in autos (with Maserati-sized baggage).

Also on deck: the S&P crosses the big 6-handle, oil prices yawn their way higher, and Circle’s IPO drops — because what the stablecoin market needed was more hype. Plus, a surprisingly intelligent discussion on IPO timing, salespeople, and the Bureau of Labor Statistics’ slow-motion hiring freeze.

THE MILLEGAN MEMO: APRIL 2025

Your new Monday commute podcast - The Capital Call: with the Millegan Brothers and we explore Stellantis (formerly Fiat-Chrysler) and Moderna’s current value propositions in the market. - Managing Partners Drew Millegan & Quinn Millegan

THE MILLEGAN MEMO: FEBRUARY 2025

Intel’s potential breakup has the company poised for exciting times, Stellantis earnings show a strong balance sheet, and the yield curve partly inverts as recession fears loom. - Managing Partners Drew Millegan & Quinn Millegan

Q4 2024 WOODWORTH CONTRARIAN QUARTERLY NEWSLETTER

We are pleased to bring you our latest quarterly newsletter for Q4 2024 after a stellar quarter.