MGP Ingredients Is Not Broken It’s Just Hungover: A Short Piece for Seeking Alpha

This will be our first full article published in Seeking Alpha - take a look here and please vote at the bottom of the Seeking Alpha article that our analysis was compelling! We were impressed with the thorough nature of the publication process through Seeking Alpha and look forward to future research articles. Learn more about why MGP Ingredients is an undervalued gem.

THE MILLEGAN MEMO: POST-NOVEMBER 2025

This month we revisit the original oil panic, the whiskey glut nobody noticed, homebuilders’ disappearing margins, the new WORM index for Oregon companies, and the only friend AI data centers really have - natural gas. In other words: 1970s stagflation, a hangover in a bourbon warehouse, housing builders racing each other to the bottom, and an energy transition that still quietly runs on methane. If you like panic, mispricing, and real assets that don’t care about your factor model, you’re in the right place. As a final note, the recent S&P rebalancing saw thirteen companies removed from the S&P 600 small cap index - three of them are current holdings. We like being part of the cast offs. This was even a signal to review each of the others as possible investment targets.

— Managing Partners Drew Millegan & Quinn Millegan

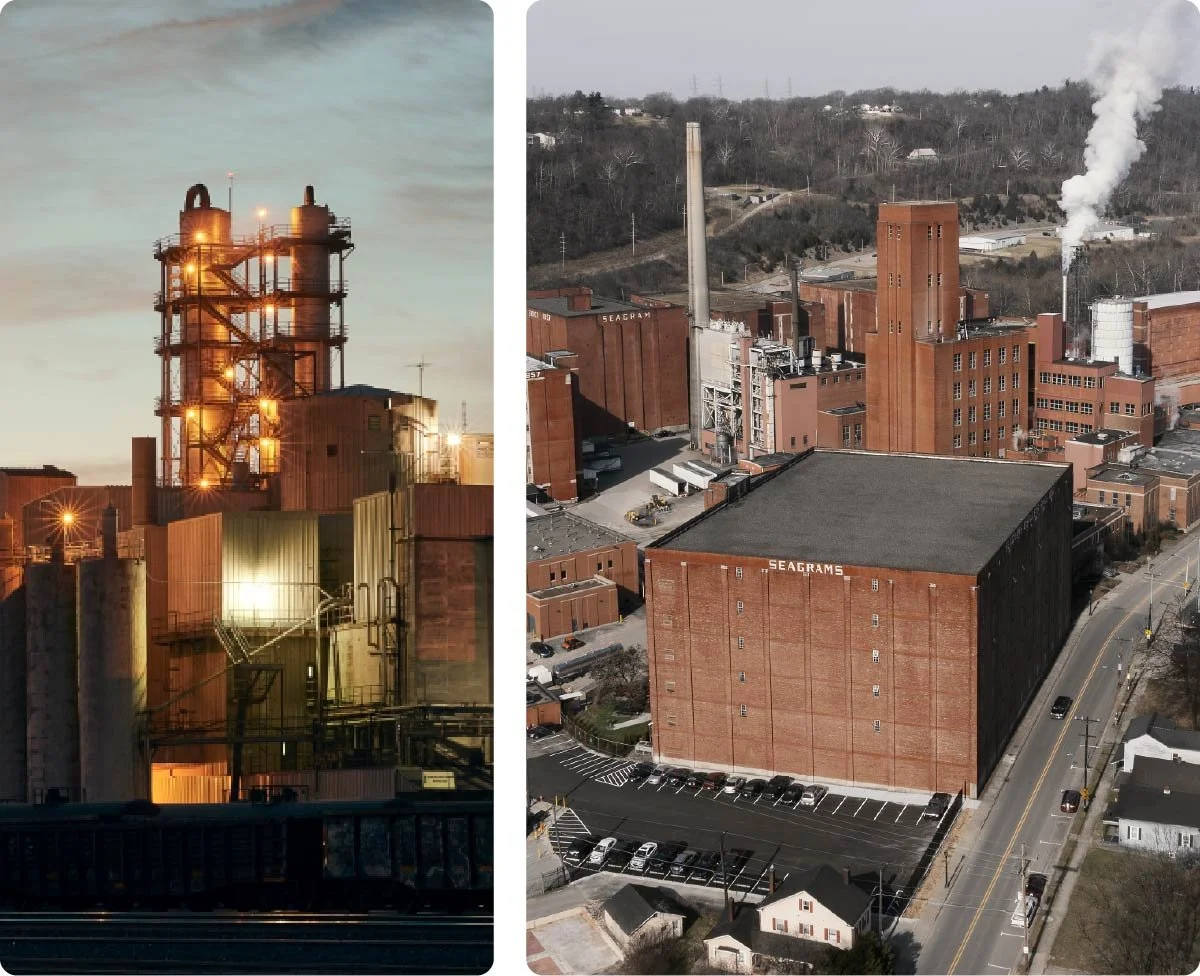

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

MGPI looks like another dead whiskey stock — down 75% in two years, trading at a “liquidation” multiple, and tossed in the penalty box for an inventory glut the market assumes will never clear. Under the hood, it’s the opposite story: cash flow is up, the balance sheet is a fortress, competitors are going bankrupt, and MGPI has nearly $470M in liquidity to buy stills, barrels, and brands at fire-sale prices. This deep dive walks through why the brown-goods crash is a textbook inventory cycle, how three growth engines (Penelope, El Mayor, and Ingredients) are being valued at roughly zero, and why our conservative work points to 50–200%+ upside with limited downside if things go wrong. If you like capital-cycle setups where sentiment has totally detached from math, this is one of them.