THE CHEMISTRY OF MISPRICING: WHY ADVANSIX (ASIX) IS A "DOLLAR FOR 50 CENTS"

Brought to you by Drew Millegan & The Woodworth Contrarian Fund

(Woodworth Contrarian / Gemini 2026)

When the market counts a company down and out, we take a second look. AdvanSix Inc. (NYSE: ASIX) is currently trading as if it were going out of business, having shed over 44% of its value in the last year. The "smart money" has fled the building, spooked by a cyclical downturn in nylon and a messy quarter.

But at Woodworth, we don't buy the narrative; we buy the numbers. And the numbers tell us that ASIX is a fortress balance sheet trading at 0.54x Book Value (0.61x Tangible Book) with a hidden cash flow catalyst that the market is completely ignoring. This is a classic "stretched rubber band" scenario where sentiment has detached from math.

AdvanSix is a US domestic chemical company specializing in many types of fertilizers, agrochemicals, plastics, solvents, packaging, paints, coatings, adhesives and electronics - though they are largely known for being one of only four fully integrated producers of nylon 6, a material widely relied upon in automotive, industrial, and textile applications. As with most chemical companies, there are significant barriers to entry for competitors in the form of fixed infrastructure and capital expenditures, which gives AdvanSix a relatively robust competitive moat compared to players in other industries.

AdvanSix’s Frankford facility, one of North America’s largest producers of phenol (ASIX Corporate 2026)

VALUE ANALYSIS: LIQUIDATION PRICING

The market hates cyclicality, and right now, the nylon cycle is at a brutal low. However, value is determined intrinsically by assets and normalized profitability, not temporary headwinds.

Trading at Half of Book: ASIX is trading at just over $16, while its Book Value sits north of $30 per share. You are literally buying the equity of this fully integrated chemical manufacturer for nearly 50 cents on the dollar.

The Yield Shield: While we wait for the cycle to turn, ASIX pays a dividend yielding nearly 3.9%. This is a "paid to wait" situation.

EV/EBITDA Dislocation: Even on depressed TTM numbers, the stock trades at an EV/EBITDA of 4.4x. Historical averages and peer valuations for chemical assets often range between 7x and 9x.

The market is pricing ASIX for a permanent impairment of its earnings power. We view this as a temporary cyclical trough in the nylon and chemical intermediates markets, obscured by the noise of raw material pass-throughs.

CASH FLOW & THE HIDDEN CATALYST

The bear case rests on the recent earnings miss (Q3 Adjusted EPS of $0.08 vs $0.40 expected) and fears of cash burn. We see a different story.

Fortress Balance Sheet: The company has a debt-to-equity ratio of just 0.18 and interest coverage of 6.33x. Unlike many distressed value plays, ASIX is not drowning in leverage. They have the liquidity to survive the winter.

The $100M Catalyst: The market is ignoring the "Section 45Q" carbon capture tax credits and 100% bonus depreciation kicking in. Management expects a cumulative benefit of $100 million to $120 million over the program's life starting in 2026/2027. For a company with a market cap of ~$450 million, this is a massive, unpriced injection of value—roughly 25% of the entire market cap coming in tax credits alone.

Cycle Turn: Plant Nutrients (Ammonium Sulfate) remain a bright spot. As semiconductor demand rebounds in 2026, the acetone/phenol chain (vital for electronics) will tighten, driving margin expansion in their Chemical Intermediates segment.

TECHNICAL ANALYSIS: THE PISTOLESE METHOD

Using the principles outlined by Clifford Pistolese in Using Technical Analysis, we examine the supply/demand dynamics to time our entry.

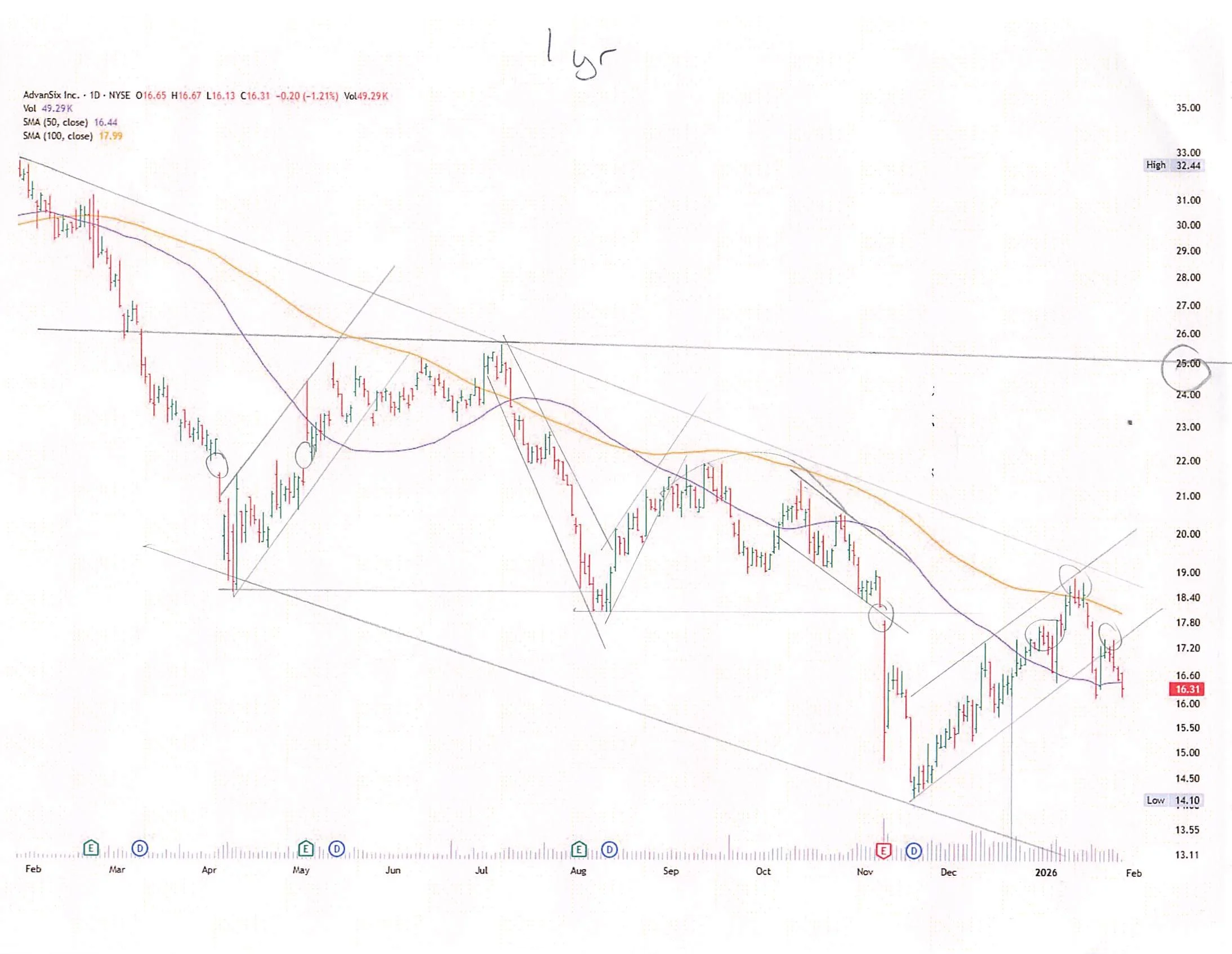

Pattern Recognition (Base Building): ASIX has been in a severe downtrend, falling from highs near $32 to a low of $14.10. However, the price action over the last few months shows signs of a Double Bottom formation around the $15-$16 level. This suggests that selling pressure is exhausting and "smart money" accumulation is beginning to absorb the supply.

Volume Analysis: Pistolese emphasizes volume as a confirmation of trend changes. We have observed volume drying up on recent pullbacks to $16, indicating a lack of aggressive sellers. Conversely, up-days have seen slightly higher volume, a subtle sign of accumulation.

Moving Averages: The stock remains below its 200-day moving average (a long-term resistance), but is consolidating near the 50-day moving average. A decisive close above $18.00 would signal a breakout from this accumulation base and a shift in momentum.

Support/Resistance:

Major Support: $14.10 - $15.00 (The "Line in the Sand").

Immediate Resistance: $18.50.

Pistolese Action: Buy in the $16-$17 range with a stop-loss slightly below the $14.00 support level. The risk/reward ratio here is highly favorable (Risking ~$2 to make ~$15).

THE VERDICT

We are contrarians. We buy when others are selling. ASIX is a diversified chemistry company essential to the fertilizer and electronics supply chains, priced as if it were obsolete.

Long-term Price Target: $32.00 We derive this target simply by a reversion to 1.0x Book Value, which is just below typical historic book valuation. This does not require heroic growth assumptions—merely a return to the mean valuation of its assets once the nylon cycle normalizes and tax credits begin to flow.

Near-term Price Target: $24.50 We derive this target by applying a low-end historical valuation of 8.29x earnings for the current year. A reversion to this price represents a return to the low end of the company’s normal valuation range. In our opinion, chemical companies are generally better treated as cyclical investments without considering dividend income - so this short-term price target is included as an alternative exit point.

Action: STRONG BUY Current Price: ~$16.05 Upside: 50-99%

Disclosure: This analysis is for informational purposes only. Position sizing, timing, and risk management are essential. Do your own due diligence.

Please note that the Woodworth Contrarian Stock & Bond Fund, LP, of which the Millegan Brothers manage and are invested in, currently hold a position of ASIX as of the publication date of this article. They may or may not choose to modify their exposure to this name for any reason at any time. This is not a recommendation to buy or sell ASIX or any other name - investments incur significant risk, our risk tolerance may be significantly higher than the average investor, and any discussion in this article does not take into consideration your individual circumstances.

DEEP ROOTS. STUBBORN GROWTH. OREGON-BASED.

Now is a great time to diversify your portfolio with an investment into an award-winning fund. Call us or visit our website to inquire on an investment today in the Woodworth Contrarian Fund as an accredited investor.

(800) 651-1996 - info@woodworth.fund - www.Woodworth.Fund

Contrarian Value-Based Hedge Fund of the Year 2022-2024

Quinn Millegan (left) & Drew Millegan (right)

About the Managers: Brothers Drew Millegan and Quinn Millegan manage the Woodworth Contrarian Stock & Bond Fund, a hedge fund based in McMinnville, Oregon. They grew up in the finance world, and specialize in contrarian investment strategies in the US Public and Private markets.

Something missing from your portfolio may be a diversification into the Woodworth Contrarian Fund for accredited investors. Now is a great time to diversify your portfolio with an investment into a multi-award-winning fund. An exposure to a value-based contrarian strategy is a unique opportunity for your long term capital that you’re seeking aggressive returns for. With nine years of the Woodworth Fund under management, the Millegan Brothers are trained stock-pickers and experienced venture capital investors with a proven track record. Give us a call today to discuss a liquid investment with independent administration and independently audited monthly statements and a personal relationship.